Fsa Carryover Limit 2025 To 2025. For those plans that allow a. For fsas that permit the carryover of unused amounts, the maximum 2025 carryover amount to 2025 is $640.

The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care. There are no changes to dependent care flexible spending account (dc fsa) limits for 2025.

Employers can allow employees to carry over $640 from their medical fsa for taxable years beginning in 2025, which is a $30 increase from 2025.

Irs Fsa Carryover To 2025 Jess Romola, In 2025, you can carry over up to $640 (up from $610 in 2025). For those plans that allow a.

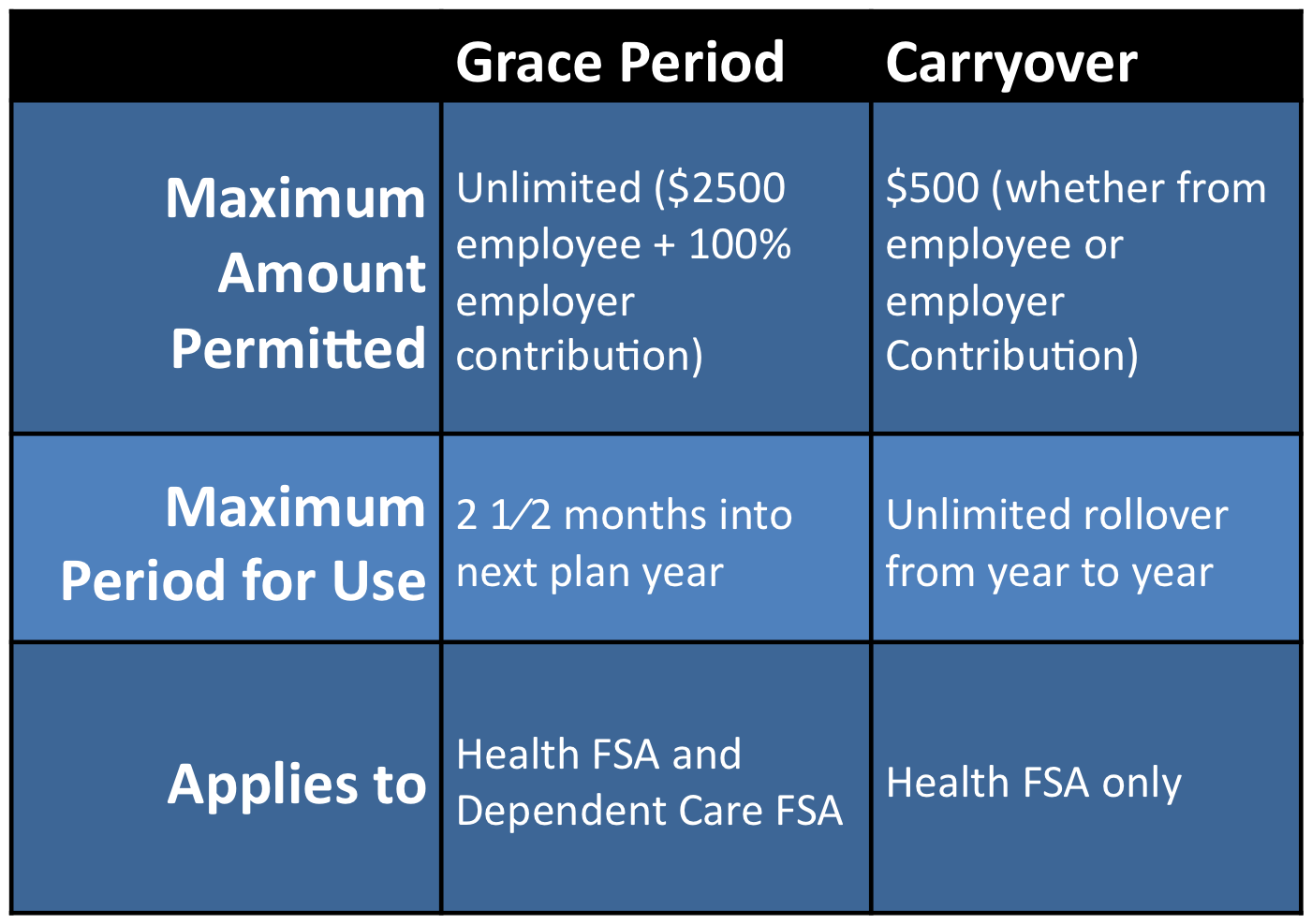

Dependent Care Fsa Limit 2025 Limit Over 65 Tresa Harriott, The fsa carryover limit provides the option to transfer a maximum amount of remaining fsa balances at a plan year's end to carryover for use during the. This is the maximum amount that can be carried over in an.

2025 Fsa And Hsa Lim … Romy Vivyan, If you don’t use all your fsa funds by the end of the plan year, you may be able to carry over $640 to 2025. For 2025, as in 2025, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and $2,500 for married couples filing separately.

Fsa Carryover Limit 2025 Irs Maire Eleanor, Employers can allow employees to carry over $640 from their medical fsa for taxable years beginning in 2025, which is a $30 increase from 2025. For cafeteria plans that allow the carryover of unused amounts, the maximum carryover amount for 2025 is $640.

Fsa Maximum 2025 Family Arlee Cacilia, For unused amounts in 2025, the maximum amount that can be carried over to 2025 is $610. This means that if you have money left in your fsa at the end of the plan year in 2025, for any reason, you can keep.

Fsa Limits 2025 Carryover Limit Glad Philis, For 2025, the maximum carryover rule is $640 in carryover funds (20% of the $3,200 maximum fsa contribution). The federal flexible spending account program (fsafeds) is sponsored by the u.s.

2025 To 2025 Fsa Rollover Limit Gennie Maritsa, For unused amounts in 2025, the maximum amount that can be carried over to 2025 is $610. 1, 2025, the contribution limit for health fsas will increase another $150 to $3,200.

Fsa Daycare Limits 2025 Elaina Stafani, The internal revenue service has upped the contribution limit on flexible spending accounts to $3,050, allowing 20% of that amount, or $610, to carry over from 2025 into 2025. For the 2025 plan year, employees can contribute a maximum of $3,200 in salary reductions.

Commuter Fsa Limits 2025 Dore Nancey, If you don’t use all your fsa funds by the end of the plan year, you may be able to carry over $640 to 2025. In 2025, employees can contribute up to $3,200 to a health fsa.

Fsa Mileage 2025 Kelsi Melitta, Limits for employee contributions to 401 (k), 403 (b), most 457 plans and the thrift savings plan for federal employees are increasing to $23,000 in 2025, a 2.2% increase from this. The 2025 maximum fsa contribution limit is $3,200.

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

For fsas that permit the carryover of unused amounts, the maximum 2025 carryover amount to 2025 is $640.